Welcome back to another monthly update from Root of Good! After a two week cruise exploring the Baltic Capitals in Europe, we’ll have almost a whole month in Raleigh before our next big trip.

During September, we spent the first couple of weeks prepping for our cruise. It took a lot of time to research the eight different cities we visited around the Baltic sea. We visited Oslo in Norway, Aarhus and Copenhagen in Denmark, Stockholm in Sweden, Kiel and Rostock in Germany, Tallinn in Estonia, and Helsinki in Finland.

As always, the visit to each port was way too short but what a fascinating trip it was! We visited five new-to-us countries. Each day, we were able to maximize our limited time to explore as much as possible. The fact that our floating hotel followed us from country to country made the rapid-fire journey much smoother.

On to our financial progress. September was another great month for our finances. Our net worth increased by $67,000 to end the month at $3,827,000. Our September income of $12,046 was way more than enough to cover our spending of $2,694 for the month.

Let’s jump into the details from last month.

Income

Investment income totaled $10,468 last month. Our equity index funds and ETFs pay dividends quarterly at the end of March, June, September, and December. As a result, we had a larger than normal amount of investment income paid in September. Here’s more on our dividend investments.

Blog income totaled $354 for last month. This represents slightly below average blog income. My advertising revenue suffered since I skipped posting one month during the summertime. Since advertiser payments lag a few months, I’m just now seeing the impact.

My early retirement lifestyle consulting income (“consulting”) was $220 during last month. That represents two hours of consulting. Times are still slow but I have received several inquiries lately that I’m waiting to hear back about. If you reach out to me and never hear back, it might be because your email is blocking my response. Leave me a comment on the consulting page and I’ll try to get in touch with you some other way.

Tradeline sales income totaled $700 during last month. I ramped up my tradeline sales a few years ago and discussed it in a bit more detail in my October 2020 monthly post and in my July 2021 monthly post. During 2024 I made over $6,000 in exchange for lending out my stellar credit history from half a dozen credit cards. 2025 is on the path to exceed the $6,000 mark.

My “deposit income” totaled $98. Of the total deposit income, $26 came from cash back and incentive bonuses from the Rakuten.com and Mrrebates.com online shopping portals (some of which was earned from you readers signing up through these links).

If you sign up for Rakuten through this link and make a qualifying $30 purchase through Rakuten, you’ll get a $30 sign up bonus.

The remaining $72 in deposit income came from a pair of Facebook class action lawsuit settlement checks. Facebook grievously injured our rights in some minor way that I cannot recall but the $72 certainly goes a long way to salve the wounds.

My bank and credit card bonuses totaled $205 last month. This bonus money came from the Chase Sapphire Reserve Pay Yourself Back feature where I reimburse myself for grocery purchases paid for with my Sapphire Reserve card.

If you’re interested in tracking your income and expenses like I do, then check out Empower Personal Dashboard, formerly known as Personal Capital (it’s free!). All of our savings and spending accounts (including checking, money market, and more than half a dozen credit cards) are all linked and updated in real time through Empower Personal Dashboard. We have accounts all over the place, and Empower Personal Dashboard makes it really easy to check on everything at one time.

Empower Personal Dashboard is also a solid tool for investment management. Keeping track of our entire investment portfolio takes two clicks. If you haven’t signed up for the free Empower Personal Dashboard service, check it out today (review here).

Tracking spending was one of the critical steps I took that allowed me to retire at 33. And it’s now easier than ever with Empower Personal Dashboard.

Pics from our port visit to Stockholm, Sweden:

Expenses

Now let’s take a look at September expenses:

In total, we spent $2,694 last month which is about $600 less than our regularly budgeted $3,333 per month (or $40,000 per year). Groceries and automotive were the top two spending categories from last month.

Detailed breakdown of spending:

Groceries – $783:

We were in town most of the month of September and spent a pretty ordinary amount of money on groceries. I haven’t seen a ton of inflation for food lately, other than beef prices.

Automotive – $658:

The annual inspection, car registration, and property taxes were due for our Hyundai Accent. These cost $20 for the inspection (with a $10 off coupon!) and $159 for the registration plus property taxes.

The remaining $479 of automotive costs came from a set of four new tires for our Toyota Sienna minivan. In a departure from my normal carefully contemplated spending, I decided to randomly check the Discount Tires website for pricing for a set of four new tires and saw that they had a Labor Day sale going on. That sale, stacked with some manufacturer discounts, let me get a set of four tires installed, including all the taxes and environmental fees for a mere $479. These were mid-grade Pirelli brand tires but only cost about 10% more than the absolute cheapest tires on sale.

The last couple of times I brought my van in for an oil change or tire rotation, the auto shop would mention how the tires were pretty worn and needed replacement soon. I didn’t see it personally, but trusted their expertise (yeah, I know they’re selling me stuff!). The old tires were 8 years old as well, and the tire shop claims tires are “expired” at 6 years of age due to potential for dry rot. I know polymers break down over time and the process can be accelerated by UV exposure from the sun.

It’s safer to go ahead and replace the tires now instead of waiting for a blow out. We just got back from a 600 mile road trip, and having brand new tires added a lot of peace of mind when I was barreling down curvy mountain roads with my family in the van. We have plenty of money so I spent the $479 for new tires as preventive maintenance.

Taxes – $400:

Our quarterly estimated taxes for the state of North Carolina came due in September. I paid $400 in taxes and an $8 convenience fee to use my credit card for payment. The $8 credit card fee is included in the “travel” expense category.

Travel – $317:

Of the travel expenses, $8 came from the convenience fee just mentioned.

Another $176 covered our incidental expenses during September for the 12 days we were traveling in Europe. A bunch of Uber/Lyft rides plus a lot of local transit tickets or train tickets. We also paid about $50 for admission to the Royal Palace in Stockholm, Sweden.

We also spent $98 for four rental cars in Hawaii that we’ll pick up on our February cruise to the islands. I had 4 coupons from Chase Travel portal that covered $50 for each rental car. We ended up booking $298 worth of rental cars for $98 out of pocket. That feels like a pretty good deal since we didn’t have much choice as to the date or pickup location since we’ll be on a cruise with a predetermined itinerary.

The remaining $51 in fees covered the seat selection on our round trip nonstop flights to London in the spring of 2026. We like the row of 2 seats near the back of the plane, and they were still available since we booked the flights very far ahead of time. For $25 each way, it’s a steal to not have to sit next to anyone for the seven hour flight. It’s almost like business class but a few thousand dollars cheaper! The flights themselves were booked with Chase Ultimate Rewards points at a cost of 38,700 points per ticket to cover the $580 cash price.

Pics from our port visit to Oslo, Norway:

Get free travel like us

If you are interested in getting free travel from your credit card like I do, consider the Chase Ink business cards (my referral link). Right now, the Chase Ink cards offers an above average $900 worth of Chase Ultimate Rewards points that can be redeemed instantly for $900 in cash (or even more for travel!).

Chase is pretty liberal when it comes to “what is a business”. If you sell stuff on eBay or Craigslist or do some odd jobs occasionally then you have a business and could get a credit card as a “sole proprietor”.

I use the 90,000 Chase Ultimate Rewards points by transferring them to my Chase Sapphire Reserve card (also offering a 60,000 point sign up bonus right now). With the Sapphire Reserve card, I can get 1.5x the points value by booking cruises, flights, hotels, or rental cars through their travel portal. For example, I used 165,000 Chase Ultimate Reward points to pay for the $2,475 in taxes, fees, and gratuities on two of my cruises.

Or I can transfer those Ultimate rewards points to over a dozen travel partners’ airline/hotel programs like United, Southwest, or Hyatt. For example, I transferred 6,500 Ultimate Rewards points to Hyatt and used them to book a $300/night room that sleeps five during the peak season in the Virginia mountains.

Another excellent choice is the 120,000 point offer for the Chase Southwest Performance Business card. Those are enough points for half a dozen round trip flights in the USA if you shop carefully. This one card sign up bonus will generate enough points to qualify for the Companion Pass so that all of your Southwest flights are essentially buy one, get one free.

Pics from our port visit to Aarhus, Denmark:

Healthcare/Medical/Dental – $232:

Our 2025 health insurance is free thanks to very generous Affordable Care Act subsidies that we receive due to our low ~$51,000 per year Adjusted Gross Income.

Our 2025 dental insurance plan normally costs $32 in premiums per month. We picked a plan from Truassure through the healthcare.gov exchange. The dental insurance does a good job of covering most of our routine cleanings, exams, and x-rays plus most of the cost of basic procedures like fillings.

Mrs. Root of Good’s dental insurance was $37 total for two months. The August dental insurance bill posted late and ended up adding to September’s dental expenses. I already prepaid my dental insurance for the remainder of 2025.

The other $195 in medical/dental expenses were the copays and deductible for some dental office visits and fillings.

Utilities – $158:

We spent $141 on our water/sewer/trash bill last month.

No electric bill in September because I paid it in October. Next month I’ll probably pay two months of electric bills.

The natural gas bill for last month totaled $17. Most of that is the monthly connection charge. Just a few dollars for the actual gas consumed by the water heater. This bill will soon increase as the days get colder and we need to crank up the heat.

Gas – $56:

A tank of gas for our Hyundai Accent and a half tank of gas for our minivan. Going forward, our kids have taken on the responsibility of paying for most gas purchases since they put the most miles on the cars with their ~400 miles per month (per person) commute to work. I’ll still fill up the cars occasionally to cover my “share” of the driving (and I am pretty generous about topping them off of course!).

Restaurants – $41:

Of the total restaurant spending, $39 of it covered takeout from a restaurant for the family.

In addition, I used the $5 Doordash credit from my Chase Sapphire Reserve card at Taco Bell and paid $2 extra to upgrade to a combo meal.

Cable/Satellite/Internet – $25:

We pay $25 per month for a local reduced rate package due to having a lower income and having kids. 50 mbit/s download, 10 mbit/s upload.

Education – $19:

A $19 fee to take the PSAT in 8th grade. This is a standardized test that should be reimbursable from our son’s 529 account under the new 2025 529 rules.

Home Maintenance – $8:

The thermal cutoff fuse for our dryer died during September. I have replaced this before about a decade ago so I was vaguely familiar with the process. I also replaced the thermostat at the same time since those two parts came together for $8 from ebay. The dryer is probably 40 years old at this point but running like a champ in general. It just needs $5-10 worth of parts every few years to keep it happy. And appliance repair is a form of DIY that I can handle easily (just don’t ask me to do any serious plumbing!).

Spending for 2025 – Year to Date

We spent $29,277 during the first nine months of 2025. This annual spending is about $700 below our budgeted $30,000 for the first nine months of the year per our $40,000 annual early retirement budget. I haven’t increased our annual budget for inflation in a decade, so at some point I need to revisit the budget numbers.

After exceeding our budget for most the year, we are now just below our spending target. Without any big surprises, we should end the year roughly on budget, plus or minus a couple thousand dollars.

Monthly Expense Summary for 2025:

Summary of annual spending from more than a decade of my early retirement:

- 2014 – $34,352

- 2015 – $23,802

- 2016 – $38,991

- 2017 – $31,708

- 2018 – $29,058

- 2019 – $25,630

- 2020 – $28,466

- 2021 – $31,740

- 2022 – $29,449

- 2023 – $37,865

- 2024 – $40,286

- 2025 – $29,277 (through 9/30/2025)

Pics from our port visit to Copenhagen, Denmark:

Net Worth: $3,827,000 (+$67,000)

Our net worth increased by another $67,000 during last month to end September at $3,827,000.

We are getting ever-closer to the magical $4 million milestone. However October hasn’t been treating us kindly so far, so we’ll see if we can hit the $4M mark by year end. It’ll probably be 2026 or later if I had to guess. But I’m wrong pretty often when it comes to stock market guesses, so we’ll see!

For the curious, our net worth reported above includes our home value (which is fully paid off). I value the house at $300,000, which is probably what we would net after sales expenses. However, please note that I don’t consider my home value as part of my portfolio for “4% rule” calculation purposes. I realize folks ask me about that every month so I just wanted to state that here for clarity.

Closing thoughts

After a whirlwind of cruises and vacations during 2025, we are finally slowing down the pace a bit and spending more time at home. We are here in Raleigh for four weeks straight other than our quick two day mountain getaway we just returned home from.

During this time at home, I’m running through my to-do list and checking off the boxes as much as I can. So far, so good! We have one more big cruise scheduled during November but other than that, we’ll be at home for most of the rest of the year.

This means we’ll be home for Thanksgiving and Christmas. Almost all of our family on my side and my wife’s side of the family live locally so our family get-togethers are pretty big. We are hosting Thanksgiving this year, so we’ll have to prepare a bit for that before our November cruise then tackle the cooking and cleaning and arrangements once we get home from our cruise.

We do have a handful of vacations planned in 2026 already but the schedule has us traveling at a slower pace compared to 2025. Which is okay with me, as I enjoy time at home, too. Being retired early means it’s always vacation time no matter where you are.

Our latest cruise in Europe was fantastic, and I’m glad to share Mrs. Root of Good’s photos with you here on the blog. We had so many great pics that I split the photos in half, and saved all of the photos from the port calls in Estonia, Finland, and Germany for the October monthly update.

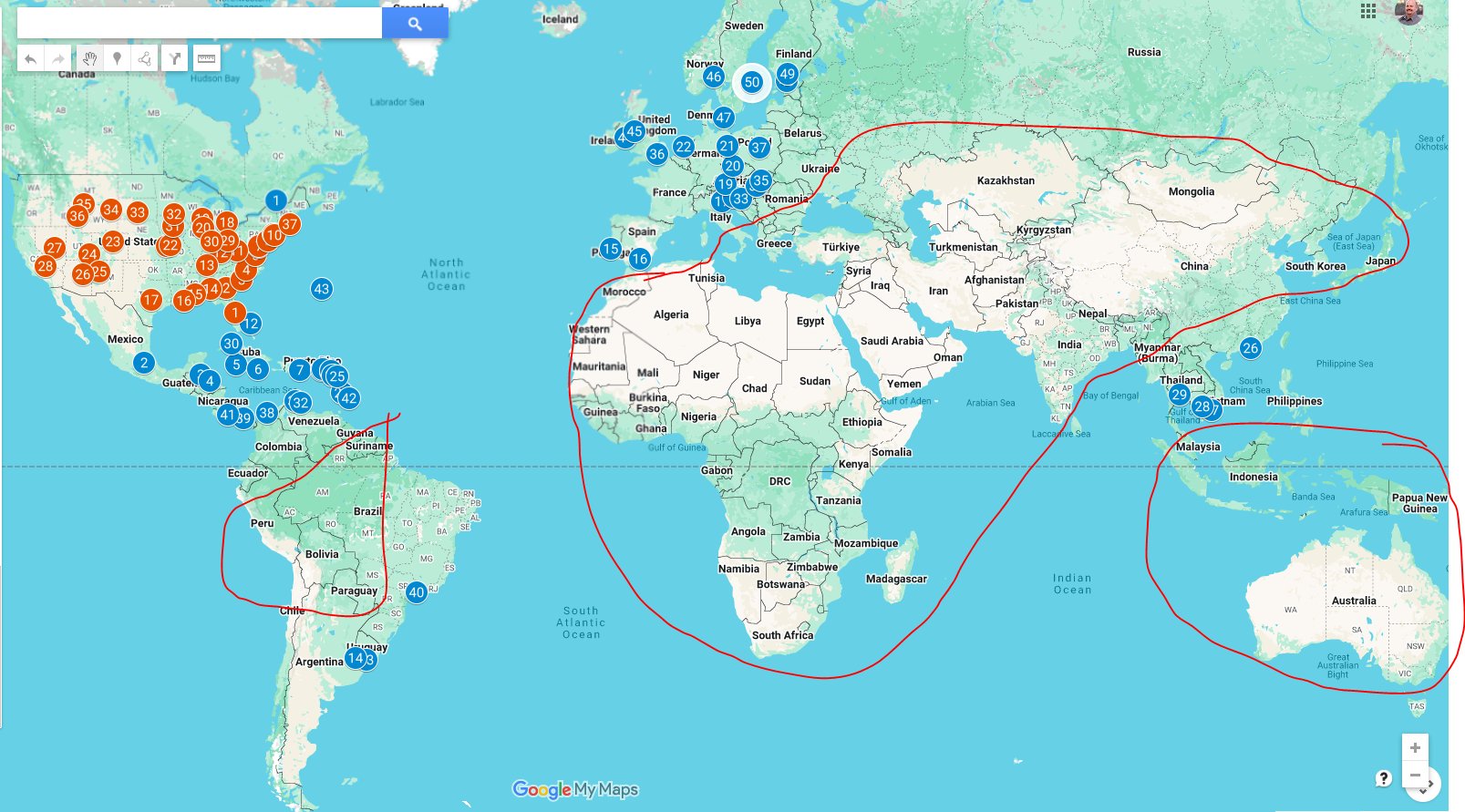

During our last cruise, we visited six countries, five of which were completely new to me. That brings my total countries visited to 51. As you can see from my “countries visited” map, we’ve barely scratched the surface of visiting everywhere in the world. We still have a giant chunk of South America and Asia to visit, plus the whole continent of Africa and Australia.

Visiting every country in the world was never my goal. I’m just grateful to have visited all these amazing places over the years. And hope to keep on hitting the road for a long time to come!

Okay, that is it from me this month. See you next time!

Who’s ready for Halloween? Thanksgiving? Christmas? It’s coming up soon!

Want to get the latest posts from Root of Good? Make sure to subscribe on Facebook, Twitter/X, or by email (in the box at the top of the page) or RSS feed reader.

Related

Root of Good Recommends:

- Personal Capital* – It’s the best FREE way to track your spending, income, and entire investment portfolio all in one place. Did I mention it’s FREE?

- Interactive Brokers $1,000 bonus* – Get a $1,000 bonus when you transfer $100,000 to Interactive Brokers zero fee brokerage account. For transfers under $100,000 get 1% bonus on whatever you transfer

- $750+ bonus with a new business credit card from Chase* – We score $10,000 worth of free travel every year from credit card sign up bonuses. Get your free travel, too.

- Use a shopping portal like Ebates* and save more on everything you buy online. Get a $10 bonus* when you sign up now.

- Google Fi* – Use the link and save $20 on unlimited calls and texts for US cell service plus 200+ countries of free international coverage. Only $20 per month plus $10 per GB data.

* Affiliate links. If you click on a link and do business with these companies, we may earn a small commission.

Discover more from Root of Good

Subscribe to get the latest posts sent to your email.